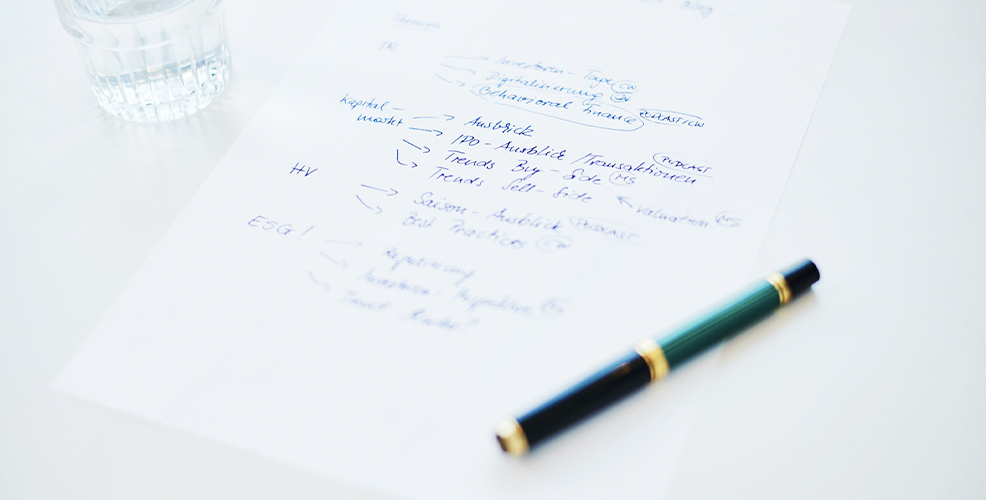

24 Oct Frankfurt Notes – Biodiversity in reporting

While the topic of "biodiversity" was a niche topic for a long time, it has recently moved noticeably into the focus of the capital markets. In an editorial published in the Börsen-Zeitung in October 2023, Wolf Brandes even called species protection a "megatrend" with reference to its increased relevance among investors. Biodiversity has also found its way into the EU...