16 Jun Frankfurt Notes – IPO: Carpe Diem

The term “Zeitenwende” (turn of the times) might be a favourite for the election of the word of the year 2022. When Olaf Scholz used this term in the German Bundestag at the end of February, it was about its political dimension: the attack on Ukraine and the return of imperialist ambition and military aggression to Europe seemed unimaginable until recently. But it is also called a turn of the times on the capital markets: inflation is back, central banks are changing course, the era of decades of declining yields seems to be over, as does the phase of simultaneously rising prices of all possible asset classes.

The capital markets need one thing above all else to sort out all these structural breaks: time – and so volatilities have shot through the roof since the end of February. The VDAX New Index of Deutsche Börse, which measures the implied volatility of the DAX for the next 30 days, peaked at close to 45, almost three times as high as at the beginning of January. Currently, the index stands at 30. For stock market candidates, this means above all a wait-and-see approach. Even though many things have changed, the following still applies: in highly volatile markets, issues can only be placed at unacceptably high discounts.

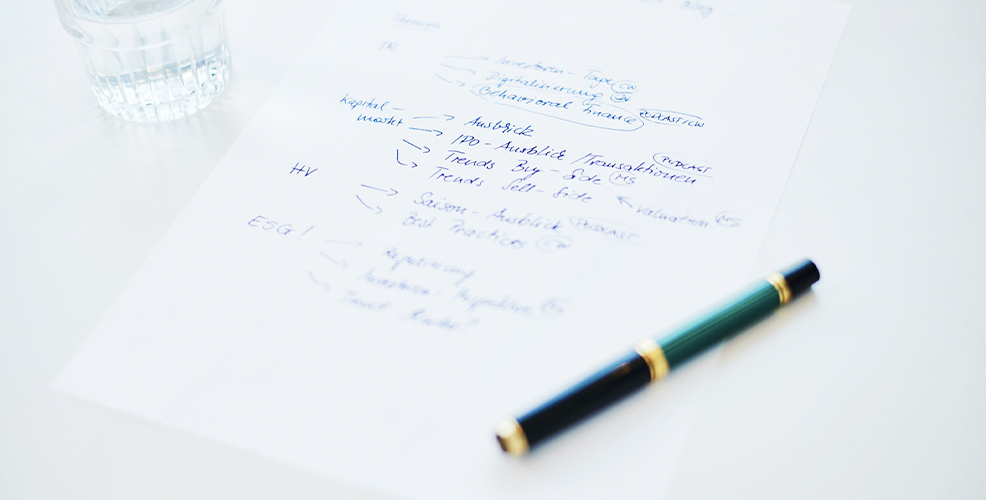

As disappointing as this may be for stock market candidates at first, it is no reason to throw in the towel. A look at the volatility index also shows how volatile the index itself is – and how quickly and sometimes abruptly issuance windows can open. For issuers this means, on the one hand, to be ready and to prepare central work strands such as prospectus, analyst presentation or IR internet presence as much as possible. On the other hand, we recommend using the time that unexpectedly arises to shed light on the preparation process and its elements and to work in a targeted manner on the critical success factors for the IPO:

Equity Story to the test bench. The turn of the times presents companies with completely new challenges. Higher financing costs, risks to the security of supply of fossil energy, significant price increases for input goods or the loss of suppliers and sales markets can call many things into question. Before investors put their finger in the wound, companies should ask themselves quite openly and honestly: Do strategy and equity story really take account of the change of times? Do the previous answers do justice to the new challenges?

Evaluate investor feedback. Those who have already had early look or pilot fishing meetings can incorporate important investor feedback into these considerations. Regardless of the quality of the substantive feedback, every issuer should critically examine with the accompanying banks to what extent the investors met so far will actually be the realistic buyers of a share placement. Highly qualified specialists in platinum sales accounts usually give particularly good feedback on the content. However, the success of an IPO placement scheduled at short notice can be determined by smaller addresses or family offices with short decision-making paths.

Test reporting processes. New reporting formats and deadlines are a real challenge for most companies after the IPO. A good answer may be to design the formats for interim reports, quarterly releases and analyst presentations early on. The even better answer is to do a realistic dry run right away, from data delivery and presentation preparation to a simulated conference call with management. This may seem laborious, but in our opinion it offers two major advantages: Companies not only involve the small, sworn-in project teams in the preparation. They also test their processes without minor or major mistakes becoming public.

Set up governance processes. With the publication of the issue price, a company’s first ad hoc announcement is usually made immediately before the IPO. But: Is there an ad hoc guideline? Has a committee been appointed? And has the decision making on possible ad hoc matters, which can hit the company very quickly and unexpectedly, already been tested? In addition, have training sessions for board members been prepared to make them aware of the – not always intuitive – reporting obligations and trading restrictions for themselves and their (household) relatives? How long are employees prohibited from trading in their own shares and what special regulations apply to critical areas of the company? Are responsibilities defined, who in the company takes over and documents which processes?

Select service providers – prepare the internet. Whether it’s notifications to BaFin and the stock exchange, keeping a share register or publishing the IR Internet presence: without service providers some processes around or after the IPO are inconceivable. For those who have not yet decided, now is the time to put services out to tender and get to know providers. The company that already has a concept ready to hand on which navigation and landing page the IR internet presence should have on the day of the listing can use scarce time after the intention-to-float for time-critical issues.

The turn of the times also affects the capital market. Many capital market projects do not seem feasible in the short term as long as volatilities remain high. However, the past also shows that it is always important to be prepared – and that the time involuntarily gained can certainly be used to improve the IPO’s later prospects of success. Carpe diem.