11 Nov Frankfurt Notes – Perception Study: plea for an event-related use

Companies and their IR officers have been able to satisfy investors’ hunger for information well in the last two years with the help of virtual conference and roadshow formats – and probably even much better than seemed realistic at the beginning of 2020. Personal relationships, on the other hand, can hardly be cultivated where physical meetings are impossible and no informal encounters take place during conference breaks or at the hotel bar in the evening. So what does this long phase of virtual speed dating mean in terms of the level of knowledge IR managers have about “their” investors?

One thing is certain: keeping an eye on the share register and regular shareholder IDs help to keep track of changes in the shareholder structure. Individual service providers with low entry prices make this affordable even for smaller public limited companies. What is missing, however, is that there is hardly any room in the virtual cosmos for substantive feedback on corporate strategy and development that goes beyond mere buy and sell signals. This applies to the casually expressed hint that a certain measure has been particularly good or perhaps less clever, as well as to the argument why.

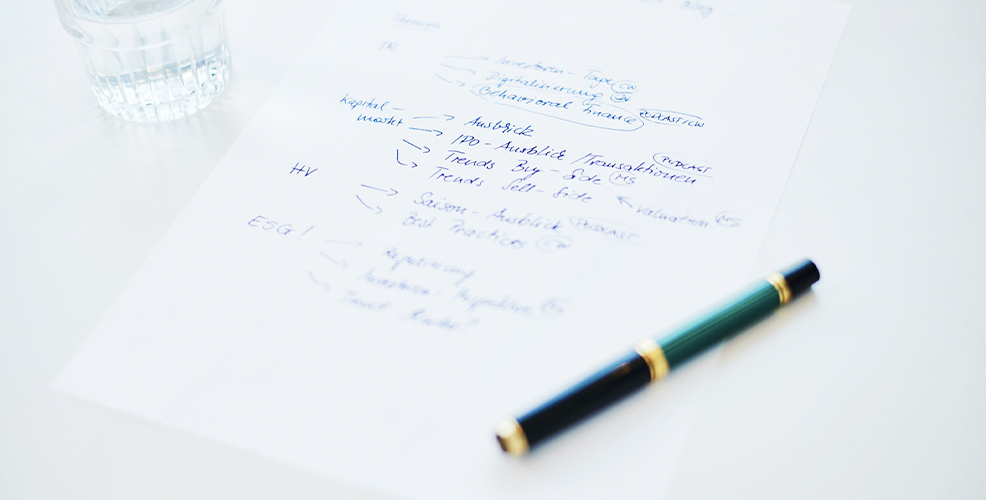

This space for exchange is created by perception study, i.e. the structured questioning of stakeholders on corporate development and strategy as well as on the people involved. Five theses on what matters from our point of view:

Contexts instead of opinion research. Do not succumb to the attempt to randomly survey as many people as possible. For conclusions that are relevant to action, meaningful, multifaceted arguments are more important than the percentage-point-accurate representation of a population. Let current shareholders as well as more critical investors and analysts have their say. A good dozen participants is enough.

Tailor-made questions instead of off-the-shelf question lists. In a well-prepared perception study, open questions and points with a very specific reference to the company are mixed together. These specific points must be hit precisely, because they determine the significance of the results. The preparation of the question list requires knowledge of your equity story and possible points of attack – and thus a deep understanding of your company and the capital marketa. The question list keeps in mind that the patience of the participants and the quality of the answers usually dwindle after three quarters of an hour.

Facts, facts, pictures. Associative questions often yield additional insights, as otherwise hidden assessments come to light. Your company as a car, animal or chocolate bar? A Dacia Logan, a dolphin or a Lindt chocolate can express the unspoken. These illustrative results are often particularly valuable for the subsequent discussion with management.

Occasion-related instead of pure routine. Don’t ask questions out of a calendar routine, but when it matters: before a strategy cycle or investor day, when taking stock for a new board member, or when the stock is in a prolonged slump. This helps you more and at the same time increases the willingness of your participants to answer in detail and openly. Many investors will already appreciate your willingness to question them at key milestones and to incorporate the results into the company’s deliberations.

Draw the right conclusions. In our opinion, the successful evaluation of a perception study depends on two decisive factors: the willingness to look closely and also to pick up on the surprising and critical, and the ability to condense the results into 3 or 4 core messages and derived recommendations for action.

In our view, these five steps can achieve a lot with limited time and resources: New insights into the views of key stakeholders can be gained. Management and IR heads can be provided with data-based proposals for action. With just a few targeted measures, your perception on the capital market can be substantially improved.