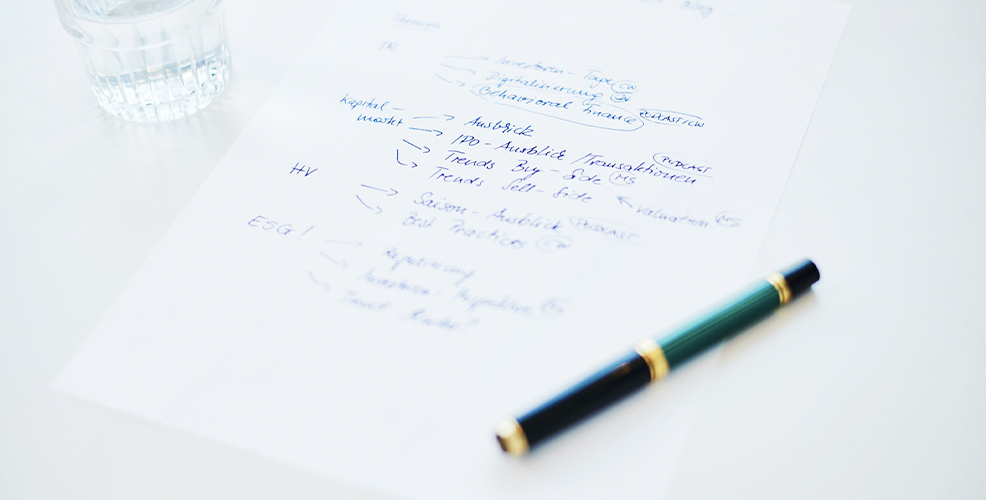

07 Sep Frankfurt Notes – Let’s talk about: Valuation

There has long been a lively discussion in the financial world about whether asset valuation should be regarded more as a quantitatively exact science or rather as an “artistic” discipline. To many company representatives, this discussion may seem quite academic in the current situation. After all, the stock market correction of the current year has hit the share prices and valuations of many companies hard – further headwinds in autumn not excluded. The last weeks and months have shown us how much this concerns company and IR managers. Company representatives are increasingly asking us about what they perceive as inadequate valuations of their companies: What can be done concretely to increase the valuation that is perceived as too low? Which IR measures can be used to convey arguments and move the share price? What is realistic and where does sustainable IR work reach its limits?

We like to classify measures from the perspective of those who determine the valuation, namely the players on the financial markets: the analysts who make recommendations, the sales people who convince potential investors – or not – and first and foremost the investors who make decisions for or against an investment. Regardless of whether these actors follow the methodically pure doctrine or see price formation more as an artful interplay of diverse factors, they all base their actions on an anchor valuation. We map this anchor with a simplified dividend discount model based on a constant growth rate of distributed earnings. In this so-called Gordon Growth model, the following applies: The value of the share is the quotient of dividends on the one hand and the difference between the cost of equity and the growth rate on the other.

The value of the company thus depends positively on the (distributed) profits and the pace of growth and negatively on the cost of equity. This sounds banal at first, but it helps to define the essential measures and to classify them according to their effect. Five starting points that, in our view, are absolutely essential for IR work that increases valuation:

Explaining profit drivers in an understandable way. Of course, the corporate result is not the result of IR work, but an expression of more or less successful corporate activity. The question of whether results are determined by one-off special factors or follow long-term trends is relevant to valuation. Investor relations creates value when it shows the sustainability of sources of earnings. Cash earnings count more than short-term valuation effects. Results from low volatility business areas are more valuable than those from highly cyclical areas. It is not about transparency over the last decimal place, but about an insightful picture of the key earnings drivers.

Operate stable and predictable balance sheet policies. The empirical results of Behavioral Finance are clear: losses are given greater weight in experiments than gains of the same amount – symmetrical bets in which candidates can win or lose the same amount with 50% probability are not attractive. With their Prospect Theory value function, Daniel Kahneman and Amos Tversky map the subjective value of changes in wealth. It follows from this: Investors attach a high value to the stability of profit and dividend series. Positive surprises compared to a reference value cannot compensate for the pain of equally high losses in other years. In case of doubt, predictability and reliability are more important than a slightly higher result over a multi-year period or a slightly higher total dividend amount. If at all possible, dividend declines must be avoided. This also builds a bridge to the cost of equity – this negative factor influencing the valuation is dampened by everything that helps reduce the volatility of an investment.

Identify growth opportunities. Those who understand the respective industry and the position of the company are best placed to assess growth potential. Especially in less well-known niches, well-founded explanations and data therefore create value. In our opinion, the degree of confidence that capital market players develop depends on two factors that can be easily influenced: Do companies have the confidence to show a perspective – even beyond the current year’s forecast? Are targets and forecast also credible because they can be recalculated by external parties and are thus easier to understand? In Behavioral Economics, one actually speaks of the IKEA effect: those who have built the Pax wardrobe or the Excel model of company Y themselves usually not only find them particularly successful, but also know very well where parts or assumptions are complete and where they fit together well or not.

Making your voice heard. All these considerations will only bear fruit if the narrative invites people to take a closer look at the company. Capital market players usually make a quick judgement based on three critical factors: 1) Attractiveness. Is the investment case convincing? Are the main arguments for the investment precisely formulated and clearly and consistently presented – on the website, in the presentation, in the dialogue with analysts and investors? 2) Comprehensibility. Is the business model presented in a few sentences and condensed on a PowerPoint page? Is the question of how the company makes money answered? For the analyst or investor who may deal with this or other companies, the trenchant elevator pitch also determines the expected ratio of workload to return opportunity. Transparent and clear financial reporting can provide an additional argument. 3) Dialogue. Is it easy to get in touch with the company, are questions answered at short notice and are appointment requests attended to even at C level? It is also about the presence at investor conferences, the intensively prepared investor day, the targeted approach to target investors, the multiplier effect of sell-side research and the fundamental willingness to engage in dialogue at eye level.

Building trust. On the surface, investors buy companies. In fact, they rely on company managers to bring the vision to life, set the right topics, achieve goals and implement agendas cleanly. Good IR work aims to build a positive track record of companies and managers, for example by formulating goals that are ambitious but also achievable. It should allow formats in which personal contact is possible. It should bring decision-makers well-prepared into dialogue situations in which they feel comfortable and can convince. And it should refrain from anything that sparks short-term euphoria but is not sustainable in the medium and long term. Trust, as we have known not only since Deutsche Bank’s earlier advertising campaign, is the beginning of everything.